I have argued many times over the years that mainstream economists, especially mainstream macroeconomists, largely ignore the issue of inequality. And when they do see it, they tend to misunderstand both its causes (often attributing it to exogenous events, such as globalization and technical change) and its consequences (often failing to connect it, other than through “political capture,” to events like the crash of 2007-08).

In my view, mainstream economists overlook or forget about the role inequality plays, especially in macroeconomic events, for two major reasons. First, their theoretical and empirical models—either based on a representative agent or undifferentiated macroeconomic relationships (such as consumption and investment)—can be solved without ever conceptualizing or measuring inequality. The models they use create a theoretical blindspot. But, second, even when it’s clear they could include inequality as a significant factor, they don’t. They literally choose not to see inequality as a relevant issue in making sense of macroeconomic fluctuations. So, as I see it, when it comes to inequality, mainstream economics (especially, as I say, mainstream macroeconomics) is haunted by both a theoretical and an ethical problem.

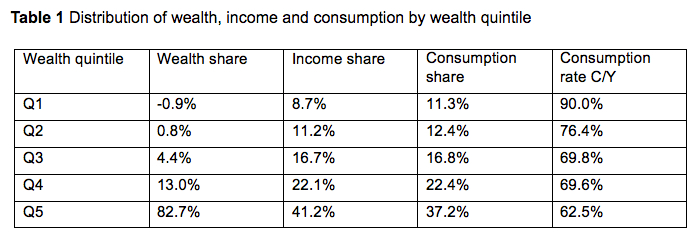

That’s why recent research by Kurt Mitman, Dirk Krueger, Fabrizio Perri is so interesting. What they show, using a standard macroeconomic model with household heterogeneity to account for an unequal wealth and consumption distribution, is that inequality does in fact matter. In particular, they demonstrate that the aggregate drop in expenditures depends on the distribution of wealth (e.g., it is much larger in an economy with many low-wealth consumers) and that the effects of a given macroeconomic shock are felt very differently in different segments of the wealth distribution (e.g., low-wealth households have little ability to insure themselves against risk, and thus the welfare impact of a recession is significantly larger for them). As a consequence, they make it abundantly clear that ignoring inequality means failing to understand the severity of a macroeconomic downturn and underestimating the welfare costs of a deep recession.

That’s not all the work that needs to be done, of course. Mitman et al. rely on exogenous macroeconomic shocks rather than analyzing how inequality itself plays a role in creating the conditions for an economic downturn. But even their limited attempt to include inequality as a significant factor in an otherwise-mainstream macroeconomic model demonstrates that such work can in fact be done.

In other words, it’s not that mainstream economists can’t make sense of inequality in their models. They simply, for the most part, choose not to.

This was originally posted on David Ruccio’s blog Occasional Links & Commentary on economics, culture and society (2 September 2016).

Comments